Introduction

In the global automotive aftermarket, China has emerged as a powerhouse for manufacturing and exporting high-quality, cost-effective brake components. From the bustling industrial clusters to leading-edge manufacturing facilities, Chinese suppliers offer a vast range of products that meet or exceed international standards. This comprehensive guide is designed to assist importers, distributors, and businesses in navigating the Chinese market for automotive brake parts, including brake pads, brake shoes, brake discs, brake drums, and brake calipers. We will delve into the types of products, key advantages, quality and safety considerations, main specifications, industrial hubs, leading manufacturers, necessary certifications, and essential tips for a successful procurement process.

Table of Contents

I. Overview of Product Types and Their Functions

The brake system is a critical safety component in any vehicle. Chinese manufacturers produce a full spectrum of parts for this system. Understanding each component is the first step in a successful sourcing strategy.

-

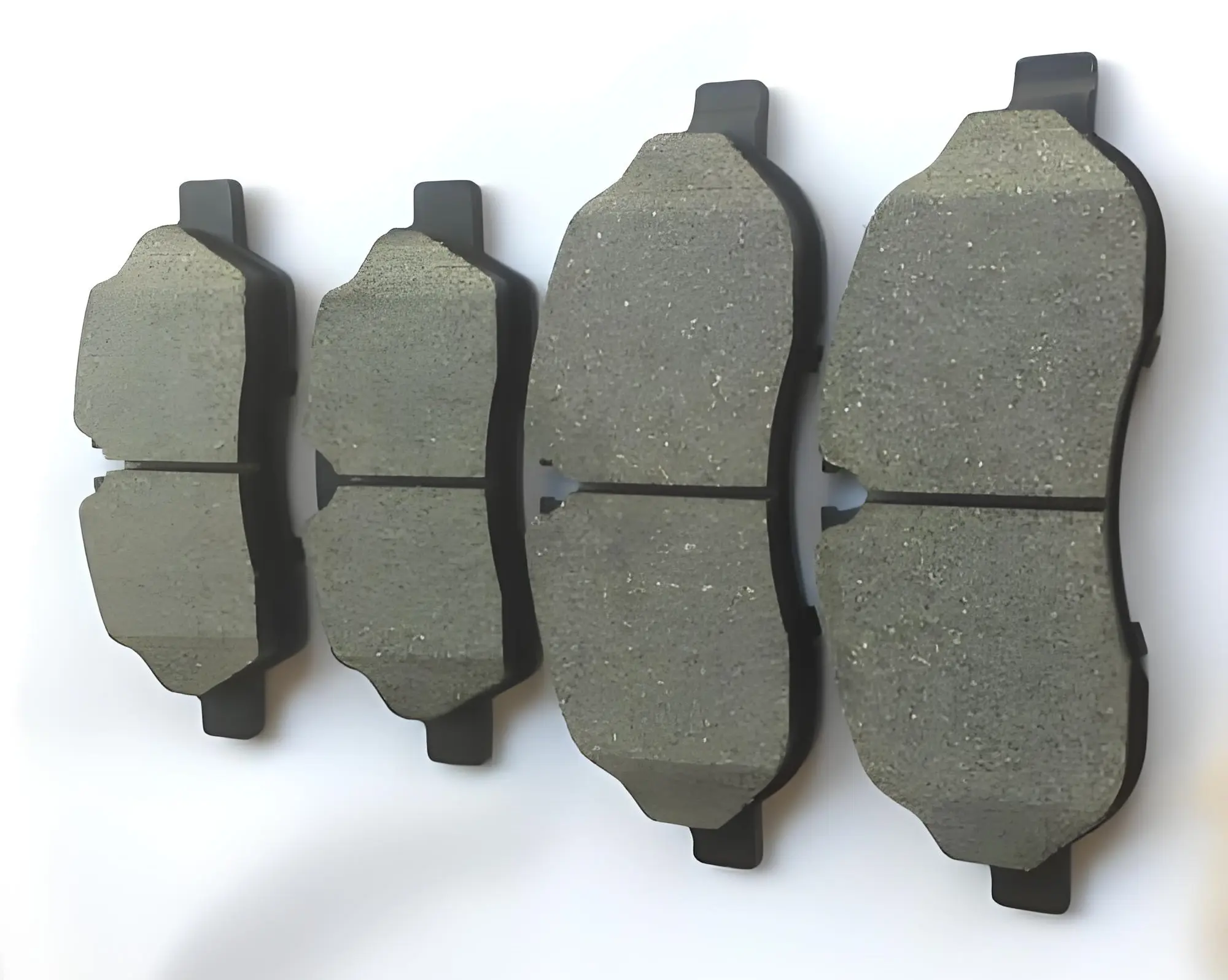

Brake Pads and Brake Shoes: These are the friction materials that press against a brake disc or drum to slow down or stop the vehicle. Brake pads are used in disc brake systems, while brake shoes are used in drum brake systems. China’s brake pad industry offers a wide variety of friction materials, including Semi-Metallic, Non-Asbestos Organic (NAO), Low-Metallic, and Ceramic formulations. Ceramic pads are particularly popular due to their low dust, low noise, and excellent heat dissipation properties.

-

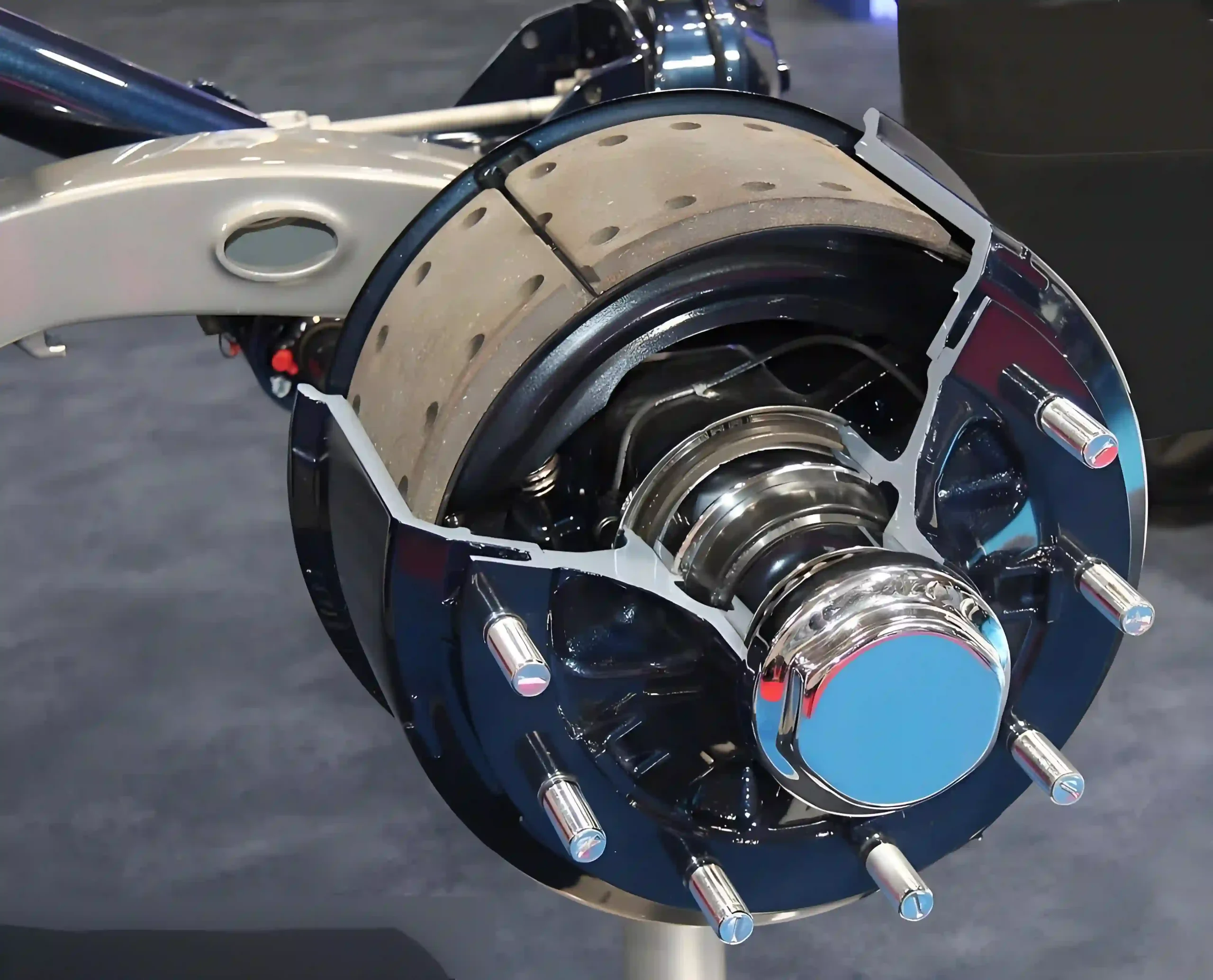

Brake Discs (Rotors) and Brake Drums: These are the rotating metal surfaces against which the friction materials of the pads or shoes are pressed. Brake discs (rotors) are used in disc brake systems, and brake drums are used in drum brake systems. Chinese factories are known for their precision casting and machining capabilities, producing high-grade cast iron and composite brake discs that are durable and resistant to thermal deformation.

-

Brake Calipers: The brake caliper is a crucial part of the disc brake system. It houses the brake pads and pistons and is responsible for squeezing the pads against the rotor. Calipers come in various designs, including fixed and floating types. Chinese manufacturers produce both types, often with a focus on lightweight design and improved corrosion resistance.

-

Brake Kits: For convenience and a complete replacement solution, many Chinese suppliers offer comprehensive brake kits. These typically include a pair of brake pads and brake discs, or a set of brake shoes and drums, designed to work together seamlessly for optimal performance.

II. Compatible Vehicle Models

Chinese automotive brake component manufacturers serve a vast range of vehicle models, catering to both domestic and international markets. Due to the high volume of production and extensive R&D, they have developed products compatible with a staggering number of car makes and models from around the world.

-

Global Coverage: Chinese suppliers produce parts for a wide range of global brands, including but not limited to, Ford, GM, Volkswagen, Toyota, Honda, Nissan, BMW, Mercedes-Benz, and Audi. They also have a strong focus on the parts needed for Chinese domestic brands like BYD, Geely, Chery, and Great Wall Motors.

-

Vehicle Segments: Whether you are sourcing for passenger cars (sedans, SUVs, hatchbacks), commercial vehicles (light trucks, heavy-duty trucks), or even industrial and off-road vehicles, China has a robust supply chain.

-

New Energy Vehicles (NEVs): With China’s leadership in the NEV sector, a new generation of brake parts is being developed specifically for electric and hybrid vehicles, focusing on regenerative braking compatibility and noise reduction.

III. Functional Advantages and Features

The rise of Chinese manufacturers in the global market is not just about price; it’s about a commitment to continuous improvement and innovation.

-

Advanced Material Science: Chinese manufacturers are investing heavily in R&D for advanced friction materials. This results in products that offer superior performance in key areas:

-

Low Noise and Vibration: Ceramic and NAO formulations are widely used to ensure quiet braking.

-

Low Dust: Ceramic pads produce significantly less brake dust, keeping wheels cleaner.

-

Enhanced Lifespan: Improved material formulas and manufacturing processes lead to longer-lasting brake pads and discs, reducing replacement frequency.

-

-

Precision and Quality: The use of advanced CNC machining and automated production lines ensures high precision and dimensional accuracy, guaranteeing a perfect fit and reliable performance.

-

Innovative Design: Many companies are developing lightweight brake components and incorporating features like slotted and drilled discs for better heat dissipation and improved braking performance under high-stress conditions.

IV. Quality, Reliability, and Safety

Safety is non-negotiable when it comes to brake components. Chinese manufacturers are increasingly focused on meeting and exceeding stringent international safety and quality standards to build trust and market share.

-

Strict Quality Control: Reputable factories have implemented rigorous quality management systems. From raw material inspection to in-process checks and final product testing, every step is meticulously monitored to ensure consistency and reliability.

-

Safety Performance: Products are subjected to various tests, including dyno testing to simulate real-world braking conditions, strength tests for brake calipers, and noise and wear-rate tests for friction materials. This ensures the products provide consistent and safe braking performance.

-

Counterfeit Prevention: To combat the issue of counterfeit products, many leading manufacturers use advanced anti-counterfeiting measures, such as unique serial numbers, QR codes, and holographic labels, allowing buyers to verify the authenticity of the product.

V. Key Specifications and Parameters

When sourcing, understanding the key specifications is crucial for ensuring product compatibility and performance.

-

Dimensional Specifications:

-

Brake Discs/Drums: Diameter, thickness, height, center hole diameter, and bolt hole circle diameter (PCD).

-

Brake Pads/Shoes: Length, width, thickness, and backing plate design.

-

Brake Calipers: Piston diameter, mounting bolt spacing, and mounting type.

-

-

Material Composition: For brake pads, key parameters include the percentage of metallic fibers, organic compounds, and ceramic materials. For discs and drums, the grade of cast iron (e.g., GG20, HT250) is a crucial indicator of strength and heat resistance.

-

Performance Metrics:

-

Coefficient of Friction (COF): A measure of the braking effectiveness. Different friction materials have different COF ratings, which are often categorized by standard codes (e.g., FF, GG).

-

Wear Rate: Indicates how quickly the brake pad or shoe wears down.

-

Noise Level: A key parameter for user comfort.

-

Thermal Stability: The ability of the component to perform consistently under high-temperature conditions.

-

VI. Industrial Clusters

China’s automotive parts industry is characterized by distinct industrial clusters, where a concentration of suppliers, manufacturers, and related services creates a highly efficient supply chain.

-

Yangtze River Delta (Shanghai, Jiangsu, Zhejiang, Anhui): This is the largest and most developed auto parts cluster in China. It is home to a vast number of both domestic and foreign-owned enterprises, specializing in a wide range of components, including brake systems, electronics, and engines. Its proximity to major ports like Shanghai and Ningbo makes it ideal for exports.

-

Pearl River Delta (Guangdong): Known for its strong manufacturing base and export-oriented economy, this region focuses on a diverse range of auto parts, including high-tech components.

-

Northeast China (Jilin, Liaoning): With a deep history in heavy industry, this cluster is centered around the traditional auto manufacturing hub of Changchun. It focuses on larger components for commercial and heavy-duty vehicles.

-

Central and Western Regions (Hubei, Chongqing, Sichuan): These areas are rapidly developing and becoming significant clusters, with companies specializing in brake systems and other key components for both traditional and new energy vehicles.

VII. Major Chinese Manufacturers and Leading Enterprises

The Chinese market is home to thousands of brake component manufacturers, but a few key players stand out for their scale, technology, and market presence.

-

Jinqilin (Shandong Gold麒麟): A leading manufacturer of friction materials, specializing in brake pads and shoes. They have a strong reputation for producing high-quality products that meet international standards and are a significant player in the global aftermarket.

-

Huayu Automotive Systems (HASCO): As a subsidiary of SAIC Motor, HASCO is one of China’s largest automotive parts conglomerates. While not exclusively focused on brakes, their extensive network includes key brake system suppliers.

-

Zhejiang Shuanghuan Driveline Co., Ltd.: While primarily a gear and transmission component manufacturer, they represent the high-quality, precision manufacturing capabilities found in the Zhejiang province, which also extends to brake systems.

-

Yongxin (永新): A Taiwan-based company with a strong presence in mainland China, specializing in aftermarket brake products. Known for their extensive mold library and flexible production, they have successfully penetrated the North American market and supply major brands.

-

Others: Many other large-scale manufacturers, such as Laizhou Santa Brake Co., Ltd., Guangzhou TTSports, Taizhou Savanini, and Danaher Automotive Parts Co., Ltd., are also recognized for their specialized production capabilities.

Inspeed

CheZVi

VIII. Relevant Certifications and Standards

Ensuring that products have the right certifications is a vital part of the procurement process. These standards guarantee that the products meet national and international safety, quality, and environmental requirements.

-

China Compulsory Certification (CCC): This is the most important mandatory certification for automotive parts exported to or sold within China. The CCC Mark indicates that a product has passed rigorous safety and quality tests according to Chinese GB standards.

-

GB 5763-2018: This is a key mandatory national standard for automotive brake linings (pads and shoes). It replaced the previous version and introduced new requirements for friction performance and, critically, a limit on hazardous substances. It restricts the content of lead, mercury, hexavalent chromium, and cadmium.

-

ISO/TS 16949 / IATF 16949: The International Automotive Task Force (IATF) 16949 standard is a global quality management system standard for the automotive industry. Many leading Chinese manufacturers are IATF 16949 certified, which demonstrates a commitment to a high level of quality management.

-

ECE R90 (E-Mark): For brake pads and shoes sold in the European market, this certification is mandatory. It ensures that aftermarket replacement parts perform equivalently to the original equipment. Many Chinese manufacturers have obtained this certification to serve their European clients.

-

SAE (Society of Automotive Engineers) and AMECA (Automotive Manufacturers Equipment Compliance Agency): These are U.S.-based standards. SAE J2975 and AMECA’s Brake Pad Friction Material Registered Program are voluntary but highly respected in the North American market.

IX. Purchasing Considerations and Best Practices

A successful sourcing strategy requires a meticulous approach to supplier selection and product verification.

-

Supplier Vetting: Do not rely solely on online platforms. Conduct thorough due diligence, including factory visits (if possible), requesting references, and checking their certifications. Pay attention to the age of the factory and its export history.

-

Quality Control and Testing: Before placing a large order, request samples for independent testing. Verify that the product’s specifications (dimensions, materials) match your requirements. It is also advisable to work with a local quality inspection agent who can conduct pre-shipment inspections.

-

Communication: Clear and consistent communication is key. Be precise about your product specifications, quality expectations, packaging requirements, and delivery schedules. Many Chinese suppliers have English-speaking sales representatives, but a strong local partner can bridge potential communication gaps.

-

Logistics and Shipping: Understand the supplier’s incoterms (e.g., FOB, CIF) and their experience with international shipping. Factor in shipping costs, customs duties, and lead times when calculating the total landed cost of your products.

-

After-Sales Support: Inquire about the supplier’s policy on returns, defects, and warranties. A reliable partner will offer good after-sales support to protect your business interests.

IX. Conclusion

China’s automotive brake component industry is a mature and dynamic sector. By carefully selecting your partners, verifying product quality through certifications and testing, and understanding the logistics of international trade, you can successfully leverage the vast manufacturing capabilities and competitive pricing that China offers. This guide provides a solid foundation for your sourcing journey, helping you to procure high-quality, reliable, and safe brake components that will serve your customers well and grow your business.